Sometimes living in Scarborough is like being in a fairy tale… especially during budget season. Common sense and financial prudence go out the window, and fantasy and wishful thinking rush in to replace them. For example, consider the “first reading” of the Fiscal 2018 budget that the Town Council unanimously approved on April 5…

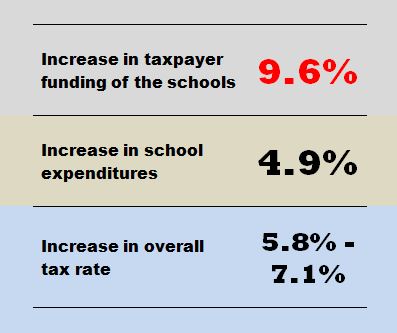

Here are a few of the key increases in the proposed Fiscal 2018 budget:

Being a good budget citizen…

Before we go any further, let’s take a deep breath and reflect on the budget process as it has played out over the past few years. We need to remember that “the budget” is presented in a 394-page book (link here). It consists of literally thousands of numbers. Some of the numbers are more important than others, and reasonable people may legitimately disagree on the relative importance of any particular number.

Before we go any further, let’s take a deep breath and reflect on the budget process as it has played out over the past few years. We need to remember that “the budget” is presented in a 394-page book (link here). It consists of literally thousands of numbers. Some of the numbers are more important than others, and reasonable people may legitimately disagree on the relative importance of any particular number.

We need to be very careful when we talk about specific numbers. For instance, any of the three increase categories above could be accurately given as representing “the budget” or major components of it. At LookOutScarborough, we try to be very precise when we talk about budget amounts.

In past budget cycles, there have been loud and sometimes strident accusations of one group or another providing “misleading” or “inaccurate” information about the budget. Most of these accusations arose because of differing perspectives on what is or is not important in the budget.

So please… be precise when you quote budget numbers. And remember that there are different ways of interpreting the numbers. No one – including members of the Town Councilor – has a monopoly on the correct interpretation of the budget.

Dismounting now from our high horse, let’s get down to the business at hand.

1. State funding of the schools will be down $1.4 million this year (subject to change based on what happens to the State budget, which will probably not be known until after our budget is finalized). A decrease of this magnitude is not a surprise; it has been expected for a few years. Although we may debate whether the State funding mechanism is “fair” or not, that’s not a particularly productive exercise. The State funding is what it is. We need to adapt to its reality.

2. The so-called “level funding” of the schools will increase by 4.9%. This means the schools’ expenses will increase about 5% just to keep on doing what they are currently doing. That is, a 5% increase just to maintain the status quo. Of course the main reason for this large increase is the teachers’ contract that the School Board agreed to last year. This year’s impact of that contract is about a 4.7% increase in teacher salaries and benefits… or perhaps more, if health insurance premiums increase more than expected. (Taxpayers pick up 80% of the school employees’ health insurance premiums. We don’t think even Santa’s Elves Union has that good a deal anymore.)

2. The so-called “level funding” of the schools will increase by 4.9%. This means the schools’ expenses will increase about 5% just to keep on doing what they are currently doing. That is, a 5% increase just to maintain the status quo. Of course the main reason for this large increase is the teachers’ contract that the School Board agreed to last year. This year’s impact of that contract is about a 4.7% increase in teacher salaries and benefits… or perhaps more, if health insurance premiums increase more than expected. (Taxpayers pick up 80% of the school employees’ health insurance premiums. We don’t think even Santa’s Elves Union has that good a deal anymore.)

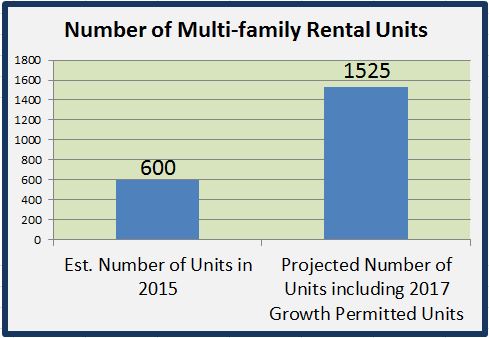

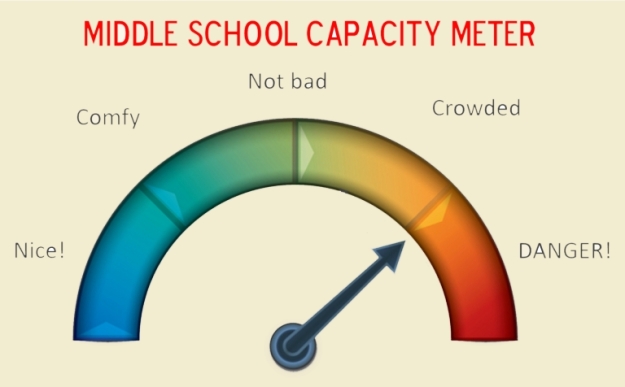

3. In spite of items #1 and 2, the schools are also planning to add about $300,000 of expenses associated with 4.8 FTE new employees. In most prudent organizations that are facing financial challenges, attempts are made to reduce costs, not increase them.

4. The budget uses $2.1 million of surplus funds from prior years (known as “fund balance”) to offset the financial drain caused by the above factors. As a frame of reference: in Fiscal 2015 and 2016, the schools generated a total of about $4.5 million of surpluses. That’s essentially our tax money that was collected in excess of what was used.

5. Municipal expenses will increase by 2.9%. Municipal revenues (excise taxes, program/service fees, etc.) will increase by 2.7%. In addition, the budget describes in detail the need for four new firefighters but does not include the $290,000 cost to fund this need.

And that, dear taxpayer, is how we arrived at those horrible increases that started off this blog. In our next blog posting we will provide our usual one-page budget summary that connects the dots and shows how the numbers are related. We guarantee it will be easier than slogging through a 394-page document… and probably more informative.

Bring on the fairy dust!

After Mr. Hall and Ms. Kukenberger gave the budget overview presentation at the Council meeting, members of the Council provided their reactions. While there was a general consensus that this was a starting point and there was still work to be done, most Councilors seemed well pleased with the budget at this point. Some hailed it as the best starting point in years.

Wait. The budget presented a total tax rate increase of between 5.8% and 7.1%. That compares to the goal set by the Town Council of “about 3% or less.” So coming in with a tax rate increase of double the goal is a good thing? (Paging Dr. Goldilocks. Patient with delirious optimism in room 6.)

Wait. The budget presented a total tax rate increase of between 5.8% and 7.1%. That compares to the goal set by the Town Council of “about 3% or less.” So coming in with a tax rate increase of double the goal is a good thing? (Paging Dr. Goldilocks. Patient with delirious optimism in room 6.)

And for the record… Last year’s budget starting point had a projected tax rate increase of 3.27%, compared to this year’s 5.8% to 7.1%. So saying that this year’s starting point is “the best in years” is just not supported by the facts.

The reactions of several Town Councilors are cited in The Forecaster’s article about the unveiling of the budget (link here). See for yourself. Better yet, watch the comments in the video-on-demand of the Council meeting (link here). The comments start at 2:03:00 of the video.

It’s going to take a ton of fairy dust to remove the odor of financial imprudence from this budget. Remember, we still think Fiscal 2018 should be the year of no tax increase. It’s going to be an interesting budget process!

Slogans for Budget Season

Marketing slogans often make us nervous. It always seems like someone is trying to sell you something you don’t need. Or trying to make their product into something it’s not.

So we were naturally skeptical when the Town rolled out the slogan for the Fiscal 2018 budget season – “One Town, One Budget.” We’re not sure just what sort of warm and fuzzy message this is supposed to convey. Perhaps that questioning the budget is a divisive act that may damage the Town’s reputation? At the very least, the slogan seems like an attempt to divert attention from the real driver of our tax increases – school funding issues.

No matter what the slogan is intended to convey, it doesn’t match up with the basic reality of our property tax system. There are actually three budgets that go into our tax bills – municipal, school and county. This fact can be readily confirmed by pulling out your tax bill and seeing the breakdown of the tax rate.

No matter what the slogan is intended to convey, it doesn’t match up with the basic reality of our property tax system. There are actually three budgets that go into our tax bills – municipal, school and county. This fact can be readily confirmed by pulling out your tax bill and seeing the breakdown of the tax rate.

The county budget gets set by the Cumberland County Commissioners and a portion of it is passed on to each city or town. At the Town level, we have no say in the county tax. The municipal budget (fire, police, public works, etc.) is prepared by the Town Manager and approved by the Town Council.

The school budget (which accounts for about two-thirds of our tax bill) is prepared by the School Superintendent, approved by the School Board and then has its total spending level approved by the Town Council. And then the school budget – and only the school budget – goes to the Town’s voters for approval.

The school budget is the only budget of the three budgets over which the Town’s voters have direct influence. When we vote on June 13, we are voting only on the school budget. As it stands now, voters would be asked to approve a 9.6% increase in taxpayer funding of the schools. The June 13 vote is our only direct opportunity to influence next year’s tax rate.

Looking ahead

Now that LookOutScarborough has survived three full budget cycles, we have a pretty good idea of how the game is played. In the next blog, we’ll provide important data and analysis, and let you know what to expect during the next couple of months. Here’s what we plan in our next blog:

-

A one-page budget worksheet that allows even a non-CPA to see all the major components of “the budget” and how they fit together.

- Some of the tactics we expect will be employed as the budget process unfolds. (Who can forget the elimination of 7th grade sports a couple years back? Or the miraculous discovery of $400,000 of unexpected excise tax revenue last year?)

- Our fearless prediction of the school budget funding level that will end up going out to the voters on June 13.

Happy trails until we meet again!

Be neighborly,

TT Hannah