1-to-1 Computing at the High School

One of the lightning rods in the current school budget proposal is the “1:1 Technology Initiative” for the High School. This program would provide a laptop computer for each of the 1,000 High School students. (Currently the School Department provides computer devices for every student in grades 3 through 8.)

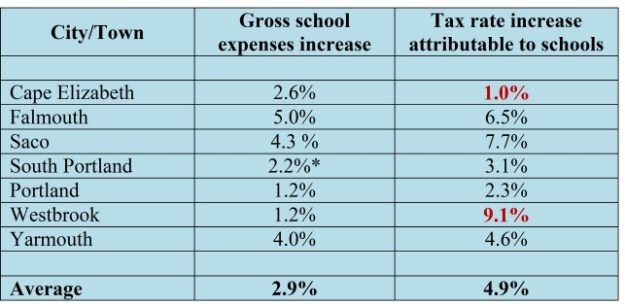

Here’s a summary of the costs of the program in the FY 2016 budget, to the best of our ability:

Yes, right around a million bucks, give or take. Or about $1,000 per High School student.

Yes, right around a million bucks, give or take. Or about $1,000 per High School student.

Now this may surprise some, but we at LookOutScarborough believe there should be a 1:1 laptop program at the High School. Kids today need to be computer literate, no matter what their future plans are. And the trend toward 1:1 programs is unmistakable, both nationally and in the local area.

We do, however, have a significant issue: is this the correct 1:1 program for the High School? We claim no expertise in computer environments for secondary education. But even casual research will reveal that there are several different ways to skin this particular cat. Our fear is that our well-meaning School leaders may have selected the most expensive skinning method and, once again, not adequately considered the financial constraints that the Town’s taxpayers face.

We have reviewed the thorough proposal (click here to download) that the School leadership prepared. And we note that they did do a financial comparison of the several computer devices that met their specifications. But there’s the rub! The financial evaluation happened after the specifications were determined. In other words, they selected specifications that fulfilled most or all of their “requirements” without examining the financial implications of those specifications.

Investing in 1:1 technology at the High School is not that different from the major investments we all make in our lives, like buying a car or house. We decide what we would ideally like to have and then temper those desires with the realities of our financial circumstances. Trade-offs need to be made between what we would like to have and what we can afford. Implementing 1:1 technology — like making a personal investment — needs to consider the buyer’s financial circumstances.

Investing in 1:1 technology at the High School is not that different from the major investments we all make in our lives, like buying a car or house. We decide what we would ideally like to have and then temper those desires with the realities of our financial circumstances. Trade-offs need to be made between what we would like to have and what we can afford. Implementing 1:1 technology — like making a personal investment — needs to consider the buyer’s financial circumstances.

In the case of 1:1 computing, the specs call for the device to have a built-in webcam and an HDMI port. Perhaps nice to have, but are they critical to have? And at what cost?

The result of having top-of-the-line specs is, as one would expect, top-of-the-line devices being recommended. That’s how we ended up with a $459 laptop being the chosen device. At a time when Chromebooks, for example, are available in the $200 – $300 range.

Speaking of Chromebooks, a recent article in Education Week stated: “Even some experts who were initially skeptical have begun touting the Chromebook’s benefits, including the ease of managing large deployments, the ways in which the computers can support student and teacher collaboration, and, especially, their cost: Most versions of the device sell for under $300.” (From: “Educators tout low cost, ease of use with Google’s digital devices” by Benjamin Herold in Education Week, November 12, 2014.)

Speaking of Chromebooks, a recent article in Education Week stated: “Even some experts who were initially skeptical have begun touting the Chromebook’s benefits, including the ease of managing large deployments, the ways in which the computers can support student and teacher collaboration, and, especially, their cost: Most versions of the device sell for under $300.” (From: “Educators tout low cost, ease of use with Google’s digital devices” by Benjamin Herold in Education Week, November 12, 2014.)

Again, we’re not suggesting that a $300 Chromebook is the answer. But we would like some assurance that we absolutely need a $459 device to have a quality 1:1 technology program at the High School. Have other local schools found less expensive alternatives? What is the “best practice” (love that buzzword!) when it comes to selecting the best combination of low cost and high quality for 1:1 technology programs?

So here are our questions:

Song and Dance Time

On April 14, the School Board presented the school budget to the Town Council’s Finance Committee. It wasn’t a particularly enlightening presentation. At one point, the School Board was trying to demonstrate its prowess and success in negotiating the labor agreements with the various unions. It turns out that’s a hard thing to do when you’re not willing to disclose the financial impact of those contracts.

On April 14, the School Board presented the school budget to the Town Council’s Finance Committee. It wasn’t a particularly enlightening presentation. At one point, the School Board was trying to demonstrate its prowess and success in negotiating the labor agreements with the various unions. It turns out that’s a hard thing to do when you’re not willing to disclose the financial impact of those contracts.

For instance, the increase in cost of the teachers’ contract was described as “per CBA steps + 2.5% COLA.” Translation: “automatic annual increases specified in the Collective Bargaining Agreement plus a 2 ½% cost-of-living adjustment.” So without understanding what the “CBA steps” are, we have no clue whatsoever of the real financial impact of the teachers’ contract. That’s like asking “how much does that sweater cost?” and being told “$50 plus another amount.” Half an answer is not better than no answer at all.

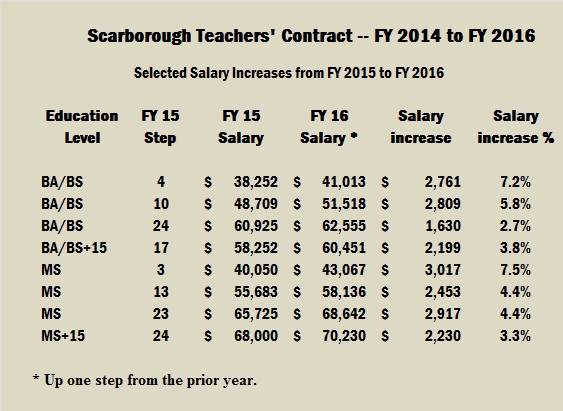

Naturally, our analytical curiosity kicked in, so we explored the real financial cost associated with the increase in teacher pay in the FY 2016 budget. The logical starting point would clearly be the union agreement itself. In it you will find the secret of “the steps.” Click here for a link to the table in the teachers’ collective bargaining agreement that lays out the salary steps

It’s not difficult to follow… A teacher’s salary is based on his or her educational level (BA/BS or Masters) and years of experience. Each year the teacher moves up a step and the salary amount associated with each step is increased based on the negotiated agreement between the School Board and the union. After 15 years or if you get a Masters’ Degree, you move to a higher step scale. The COLA increases are built into the annual step scales. And there are other add-ons available. But that’s the basic outline.

So, for instance, a teacher with a BA/BS and at step 10 (i.e., 9 years’ experience) will have a base salary of $48,709 in FY 2015. In FY 2016, that teacher will move to step 11 and receive a salary of $51,518, an increase of $2,809 or 5.8%.

The following table shows a sample of increases for FY 2016 for a few different education and experience levels. You will note that the steps appear to be arranged so that teachers get much larger percentage increases in the early years of their careers.

So how much of a pay increase are our teachers getting in FY 2016? Depending on the teacher’s education/experience, the increase will be between about 2.5 and 7.5 %. To the best of our calculating ability, the total annual increase in teachers’ salaries in the FY 2016 budget is about 4%. We wish we could be more precise with this number, but current School Department reporting does not allow us to perform an accurate calculation of this fundamental statistic. Please note that we are simply attempting to report facts here and not making any value judgments on the amount of the increases.

Conclusion: Our current teachers’ contract includes automatic raises of between 2.5% and 7.5% in FY 2016, with an overall increase of about 4% — at a time when inflation has averaged about 2.0% between 2010 and 2014. Indeed, for the twelve months ended March, 2015, inflation was actually slightly negative (that is, we experienced slight deflation).

So here are our questions…

Please don’t forget about the TOWN BUDGET FORUM to be held at 7pm on Wednesday, April 29 at the High School. This may be a once-in-a-lifetime opportunity to hear Town and School officials talk about the Municipal and School budgets and answer our questions about them. They are now soliciting questions in advance through the Town and School websites. Please take advantage of this opportunity to ask about the things that may have been bugging you. (Don’t hesitate to submit some of the same questions outlined in this blog. The more often they get the same question, the more likely it will get addressed.) Click here for a link to the web form where you can submit your questions to the Town/Schools.

As an added incentive to ask a question or two, LookOutScarborough.com is sponsoring a “best question” contest. To be eligible, just submit a question to the Town or Schools and let us know what your question was – either through the “Leave a Reply” button at the end of this post or an email to tthannah@yahoo.com. (The “Leave a Reply” option is public, the email option is private.)

Here are the prizes the winner may select from:

Submitted questions, including those asked from the floor on April 29, will be reviewed by our blue-ribbon panel of judges. The best question will be selected based on the following criteria:

* Question content (75%) – Does the question zero in on an important factor that is currently not addressed in the budget? Will the answer to the question give the public significant insight into the budget?

* Question style (25%) – Is the question asked in a clear, non-confrontational manner that encourages a straightforward and unambiguous answer?

Decision of the judges is final. Prizes may not be redeemed for cash. In the event of a tie, multiple prizes may be awarded at the discretion of the judges. LookOutScarborough.com’s employees, its affiliates and their family members are not eligible.

One last plea…

The Town Budget Forum is coming up soon – Wednesday, April 29 at 7pm at the High School. This will be a unique (at least in modern times) opportunity to hear about the Town and School budgets and ask questions of Town and School officials.

The Town Budget Forum is coming up soon – Wednesday, April 29 at 7pm at the High School. This will be a unique (at least in modern times) opportunity to hear about the Town and School budgets and ask questions of Town and School officials.

Unfortunately, this opportunity has not been well publicized. For instance, there hasn’t been a peep in the three local papers about this meeting through the issues of April 16-17. That means any notice in the papers will come April 23-24, the end of school vacation week, and less than a week before the grand event.

Please take a moment right now and do two things: (1) make sure the Budget Forum is on your calendar, and (2) call or email friends and tell them about this event. We need a strong turnout at this event to let Town and School officials that we are indeed concerned by the “first reading” tax rate increase of 8.5%.

That’s it for now, folks. Stay informed. Speak up. Share this blog.

Happy Patriots Day!